Loading ...

Loading ...

-

Currency Pair: CADJPY

Timeframe: 15 mins

Date/Time of Signal: 16th March 2020 / 1630hrs (SGT)

Review:

Last Saturday (14th March 2020), Bank of Canada (BoC) carried out an emergency cut of interest rate by 0.50% as a “proactive measure taken in... moreCurrency Pair: CADJPY

Timeframe: 15 mins

Date/Time of Signal: 16th March 2020 / 1630hrs (SGT)

Review:

Last Saturday (14th March 2020), Bank of Canada (BoC) carried out an emergency cut of interest rate by 0.50% as a “proactive measure taken in light of the negative shocks to Canada’s economy arising from the COVID-19 pandemic and the recent sharp drop in oil prices”.

With the worsening condition of the coronavirus outbreak and the continuing drop in oil prices, the Canadian Dollar is likely to weaken against Yen.

Recently, CADJPY has been on a downtrend and has retested and unable to break through the Resistance level of 76.80.

Trade signaled to SELL CADJPY (Entry: 76.50) with 3 Take Profit (TP) Targets (TP1: 76.30, TP2: 76.10, TP3: 75.90) and Stop Loss (SL) at 76.80.

Join us today at

Telegram: https://t.me/forexbriefcasesignalsFREE />

https://www.alpssocial.com/circle/forexbriefcase />

#forex #forexTradingAsia #education #signal #invest #trading #dailypips less

Currency Pair: CADJPY

Timeframe: 15 mins

Date/Time of Signal: 16th March 2020 / 1630hrs (SGT)... moreCurrency Pair: CADJPY

Timeframe: 15 mins

Date/Time of Signal: 16th March 2020 / 1630hrs (SGT)

Review:

Last Saturday (14th March 2020), Bank of Canada (BoC) carried out an emergency cut of interest rate by 0.50% as a “proactive measure taken in light ...

-

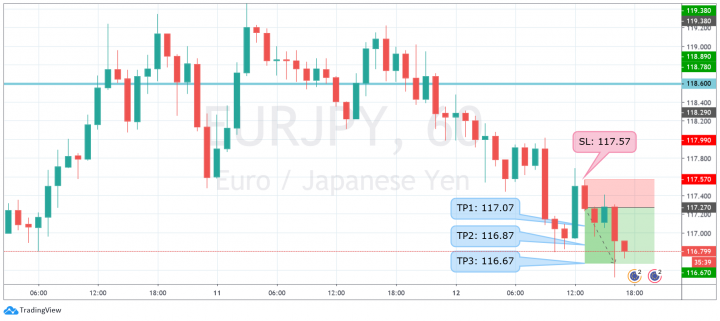

Currency Pair: EURJPY

Timeframe: H1

Date/Time of Signal: 12th March 2020 / 1400hrs (SGT)

Review:

Expectations are running high that ECB will move to substantially ease monetary policy on Thursday (12th March 2020) in a meeting coming a day after an... moreCurrency Pair: EURJPY

Timeframe: H1

Date/Time of Signal: 12th March 2020 / 1400hrs (SGT)

Review:

Expectations are running high that ECB will move to substantially ease monetary policy on Thursday (12th March 2020) in a meeting coming a day after an emergency interest rate cut by the Bank of England and in the wake of the Federal Reserve’s surprise cut last week.

The spread of the coronavirus is still driving investors to safe haven currency such as YEN.

EURJPY has been on a downtrend and below the Resistance level of 118.60.

Following the trend, trade signaled to sell EURJPY (Entry: 117.27) with 3 Take Profit (TP) Targets (TP1: 117.07, TP2: 116.87, TP3: 116.67) and Stop Loss (SL) at 117.57.

Join us today at

Telegram: https://t.me/forexbriefcasesignalsFREE />

https://www.alpssocial.com/circle/forexbriefcase />

#forex #forexTradingAsia #education #signal #invest #trading #dailypips less

Currency Pair: EURJPY

Timeframe: H1

Date/Time of Signal: 12th March 2020 / 1400hrs (SGT)... moreCurrency Pair: EURJPY

Timeframe: H1

Date/Time of Signal: 12th March 2020 / 1400hrs (SGT)

Review:

Expectations are running high that ECB will move to substantially ease monetary policy on Thursday (12th March 2020) in a meeting coming a day after an e...

-

Channels Recommended for You

-

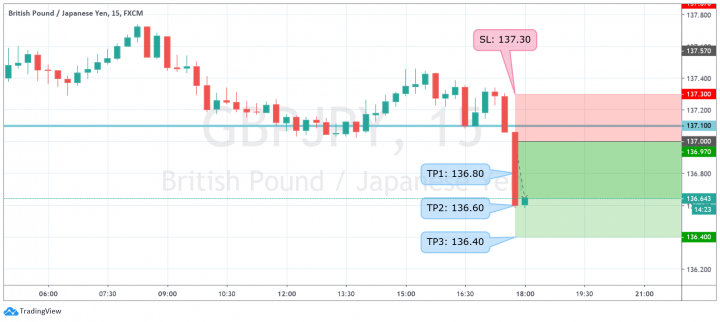

Currency Pair: GBPJPY

Timeframe: 15 mins

Date/Time of Signal: 6th March 2020 / 1745hrs (SGT)

Review:

The extension of coronavirus (COVID-19) carnage have kept investors avoiding the risks while keeping safe havens like the Japanese Yen on the... moreCurrency Pair: GBPJPY

Timeframe: 15 mins

Date/Time of Signal: 6th March 2020 / 1745hrs (SGT)

Review:

The extension of coronavirus (COVID-19) carnage have kept investors avoiding the risks while keeping safe havens like the Japanese Yen on the platter.

GBPJPY has been on a downtrend and broke the Support level of 137.10.

Following the trend, trade signaled to sell GBPJPY (Entry: 137.00) with 3 Take Profit (TP) Targets (TP1: 136.80, TP2: 136.60, TP3: 136.40) and Stop Loss (SL) at 137.30.

Join us today at

Telegram: https://t.me/forexbriefcasesignalsFREE />

https://www.alpssocial.com/circle/forexbriefcase />

#forex #forexTradingAsia #education #signal #invest #trading #dailypips less

Currency Pair: GBPJPY

Timeframe: 15 mins

Date/Time of Signal: 6th March 2020 / 1745hrs... moreCurrency Pair: GBPJPY

Timeframe: 15 mins

Date/Time of Signal: 6th March 2020 / 1745hrs (SGT)

Review:

The extension of coronavirus (COVID-19) carnage have kept investors avoiding the risks while keeping safe havens like the Japanese Yen on the platter....

-

Currency Pair: EURJPY

Timeframe: H1

Date/Time of Signal: 5th March 2020 / 1545hrs (SGT)

Review:

International Monetary Fund (IMF) Managing Director Kristalina Georgieva said the global economic outlook has shifted to “more dire scenarios” as the... moreCurrency Pair: EURJPY

Timeframe: H1

Date/Time of Signal: 5th March 2020 / 1545hrs (SGT)

Review:

International Monetary Fund (IMF) Managing Director Kristalina Georgieva said the global economic outlook has shifted to “more dire scenarios” as the coronavirus has spread undetected. And the Eurozone is likely to have been more adversely impacted by the spread of the coronavirus.

The spread of the coronavirus is still driving investors to safe haven currency such as YEN.

EURJPY has been on a downtrend and below the Resistance level of 121.10.

Following the trend, trade signaled to sell EURJPY (Entry: 119.48) with 3 Take Profit (TP) Targets (TP1: 119.28, TP2: 119.08, TP3: 118.88) and Stop Loss (SL) at 119.78.

Join us today at

Telegram: https://t.me/forexbriefcasesignalsFREE />

https://www.alpssocial.com/circle/forexbriefcase />

#forex #forexTradingAsia #education #signal #invest #trading #dailypips less

Currency Pair: EURJPY

Timeframe: H1

Date/Time of Signal: 5th March 2020 / 1545hrs (SGT)... moreCurrency Pair: EURJPY

Timeframe: H1

Date/Time of Signal: 5th March 2020 / 1545hrs (SGT)

Review:

International Monetary Fund (IMF) Managing Director Kristalina Georgieva said the global economic outlook has shifted to “more dire scenarios” as the coron...

-

Currency Pair: USDJPY

Timeframe: H1

Date/Time of Signal: 5th March 2020 / 1500hrs (SGT)

Review:

International Monetary Fund (IMF) Managing Director Kristalina Georgieva said the global economic outlook has shifted to “more dire scenarios” as the... moreCurrency Pair: USDJPY

Timeframe: H1

Date/Time of Signal: 5th March 2020 / 1500hrs (SGT)

Review:

International Monetary Fund (IMF) Managing Director Kristalina Georgieva said the global economic outlook has shifted to “more dire scenarios” as the coronavirus has spread undetected.

The spread of the coronavirus is still driving investors to safe haven currency such as YEN.

USDJPY has been on a downtrend and below the Resistance level of 108.50.

Following the trend, trade signaled to sell USDJPY (Entry: 107.23) with 3 Take Profit (TP) Targets (TP1: 107.03, TP2: 106.83, TP3: 106.63) and Stop Loss (SL) at 107.53.

Join us today at

Telegram: https://t.me/forexbriefcasesignalsFREE />

https://www.alpssocial.com/circle/forexbriefcase />

#forex #forexTradingAsia #education #signal #invest #trading #dailypips less

Currency Pair: USDJPY

Timeframe: H1

Date/Time of Signal: 5th March 2020 / 1500hrs (SGT)... moreCurrency Pair: USDJPY

Timeframe: H1

Date/Time of Signal: 5th March 2020 / 1500hrs (SGT)

Review:

International Monetary Fund (IMF) Managing Director Kristalina Georgieva said the global economic outlook has shifted to “more dire scenarios” as the coron...

-

Currency Pair: GBPJPY

Timeframe: H1

Date/Time of Signal: 4th March 2020 / 1315hrs (SGT)

Review:

With no clarity of post-Brexit EU-UK trade terms and the worsening condition of the coronavirus outbreak, the Pound is likely to weaken against... moreCurrency Pair: GBPJPY

Timeframe: H1

Date/Time of Signal: 4th March 2020 / 1315hrs (SGT)

Review:

With no clarity of post-Brexit EU-UK trade terms and the worsening condition of the coronavirus outbreak, the Pound is likely to weaken against Yen.

GBPJPY has been on a downtrend below the Resistance level of 139.20.

Following the trend, trade signaled to sell GBPJPY (Entry: 137.57) with 3 Take Profit (TP) Targets (TP1: 137.37, TP2: 137.17, TP3: 136.97) and Stop Loss (SL) at 137.87.

Join us today at

Telegram: https://t.me/forexbriefcasesignalsFREE />

https://www.alpssocial.com/circle/forexbriefcase />

#forex #forexTradingAsia #education #signal #invest #trading #dailypips less

Currency Pair: GBPJPY

Timeframe: H1

Date/Time of Signal: 4th March 2020 / 1315hrs... moreCurrency Pair: GBPJPY

Timeframe: H1

Date/Time of Signal: 4th March 2020 / 1315hrs (SGT)

Review:

With no clarity of post-Brexit EU-UK trade terms and the worsening condition of the coronavirus outbreak, the Pound is likely to weaken against Yen.

GBPJP...

-

Currency Pair: CADJPY

Timeframe: H1

Date/Time of Signal: 4th March 2020 / 1315hrs (SGT)

Review:

The U.S. Federal Open Market Committee announced an emergency interest rate cut of 0.50% on Tuesday,

which may leave the Bank of Canada with little... moreCurrency Pair: CADJPY

Timeframe: H1

Date/Time of Signal: 4th March 2020 / 1315hrs (SGT)

Review:

The U.S. Federal Open Market Committee announced an emergency interest rate cut of 0.50% on Tuesday,

which may leave the Bank of Canada with little choice but to cut.

With the worsening condition of the coronavirus outbreak and the recent plunge in oil prices, the Canadian Dollar is likely to weaken against Yen.

Recently, CADJPY has been on a downtrend and has retested and unable to break through the Resistance level of 81.60.

Trade signaled to SELL CADJPY (Entry: 80.40) with 3 Take Profit (TP) Targets (TP1: 80.20, TP2: 80.00, TP3: 79.80) and Stop Loss (SL) at 80.70.

Join us today at

Telegram: https://t.me/forexbriefcasesignalsFREE />

https://www.alpssocial.com/circle/forexbriefcase />

#forex #forexTradingAsia #education #signal #invest #trading #dailypips less

Currency Pair: CADJPY

Timeframe: H1

Date/Time of Signal: 4th March 2020 / 1315hrs (SGT)... moreCurrency Pair: CADJPY

Timeframe: H1

Date/Time of Signal: 4th March 2020 / 1315hrs (SGT)

Review:

The U.S. Federal Open Market Committee announced an emergency interest rate cut of 0.50% on Tuesday,

which may leave the Bank of Canada with little choice...

-

Currency Pair: AUDJPY

Timeframe: H1

Date/Time of Signal: 27th February 2020 / 1400hrs (SGT)

Review:

The Australian Private Capital Expenditure q/q data released earlier today was worse than forecasted.

And the spread of the coronavirus is still... moreCurrency Pair: AUDJPY

Timeframe: H1

Date/Time of Signal: 27th February 2020 / 1400hrs (SGT)

Review:

The Australian Private Capital Expenditure q/q data released earlier today was worse than forecasted.

And the spread of the coronavirus is still gripping investors into a state of fear and driving investors to safe haven currency such as YEN.

AUDJPY is on a downtrend and has broken the Support level of 72.50.

Following the trend, trade signaled to sell AUDJPY (Entry: 72.08) with 3 Take Profit (TP) Targets (TP1: 71.88, TP2: 71.68, TP3: 71.48) and Stop Loss (SL) at 72.38.

Join us today at

Telegram: https://t.me/forexbriefcasesignalsFREE />

https://www.alpssocial.com/circle/forexbriefcase />

#forex #forexTradingAsia #education #signal #invest #trading #dailypips less

Currency Pair: AUDJPY

Timeframe: H1

Date/Time of Signal: 27th February 2020 / 1400hrs (SGT)... moreCurrency Pair: AUDJPY

Timeframe: H1

Date/Time of Signal: 27th February 2020 / 1400hrs (SGT)

Review:

The Australian Private Capital Expenditure q/q data released earlier today was worse than forecasted.

And the spread of the coronavirus is still grippi...

Loading ...

There are no more results to show.